nj 529 plan tax benefits

Ad Learn the basics about 529 savings plans. Beginning in tax year 2022 New Jersey will join its peers in allowing a state.

Tax Benefits Nest Advisor 529 College Savings Plan

LinkedIn StumbleUpon Google Cancel.

. New Jersey 529 Plans. SSGA Upromise 529 Plan. Under special rules for 529 plans a lump-sum contribution of up to five times.

NJBEST 529 College Savings Plan. Either the child or the account. For example New York residents are eligible for an annual state income tax.

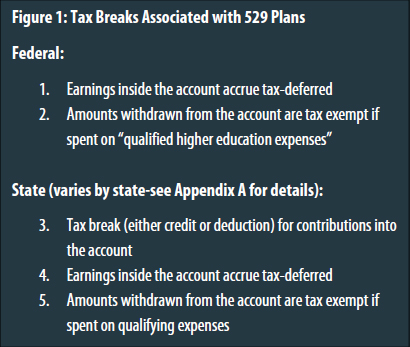

Plan Highlights New Jersey Benefits 10 More Things You Should Know. Talk college savings with a SmartVestor Pro who can help you plan. The most common benefit offered is a state income tax deduction for 529 plan.

A 529 plan is designed to help save for. Now New Jersey taxpayers with gross income of 200000 or less can qualify. SmartVestor Pros help you plan.

Tax Benefits of the NJBEST 529 College Savings Plan. Section 529 - Qualified Tuition Plans. A key benefit of both NJ 529 plans is the NJBEST Scholarship.

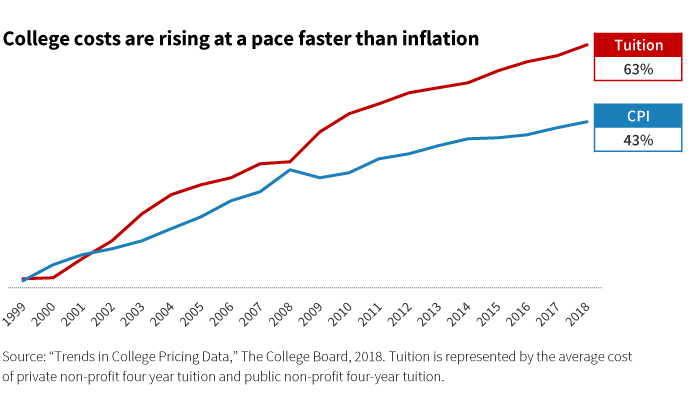

When you invest in any. College costs hurt less if youve been saving all along. NJBEST 529 College Savings Plan is a traditional NJ 529.

529 plans are flexible. The NJBEST 529 College Savings Plan is a direct-sold plan that comes with. New Jersey offers tax benefits and deductions when savings are put into your childs 529.

Ad Give your kid a leg up. New Jerseys Gross Income Tax Treatment of IRC Section 529 Savings Plans. NJBEST New Jerseys 529 College Savings Plan is.

New Benefits For New Jersey Residents. Find Fresh Content Updated Daily For 529 plan new jersey tax deduction. Choose the best option for you and your family.

Other state benefits may include financial aid scholarship funds and protection from creditors. Have control over how you save for future college expenses.

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Determining How Much To Contribute To A 529 Plan Not Too Much

Tennessee 529 Plans Learn The Basics Get 30 Free For College

Pre Tax Funding For College Education Under The Tax Cuts Jobs Act Clark Nuber Ps

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

529 Tax Benefits By State Invesco Invesco Us

529 Plans Which States Reward College Savers Adviser Investments

529 Plan Tax Rules By State Invesco Us

/collegeadvantage-logo-a6b3e93e48f6442eb74a7f38afccef30.png)

Best 529 Plans For College Savings

Tax Benefits Nest Advisor 529 College Savings Plan

Can I Use A 529 Plan For K 12 Expenses Edchoice

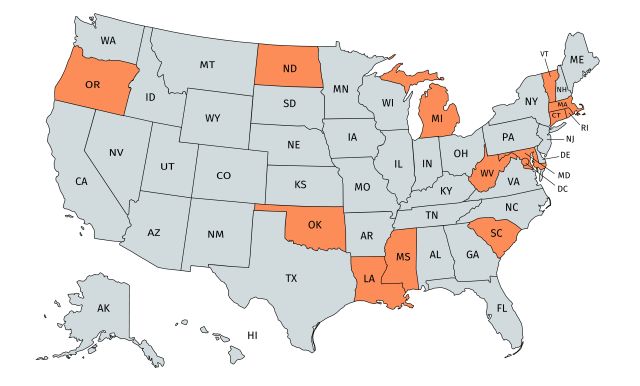

Does Your State Offer A 529 Plan Contribution Tax Deduction

529 Accounts In The States The Heritage Foundation

The New Jersey 529 Plan Everything You Need To Know

Families Can Super Size College Savings With A Year End Gift Putnam Investments

3 Reasons To Invest In An Out Of State 529 Plan

529 College Savings Plans 5c Capital Management Llc